closed end fund liquidity risk

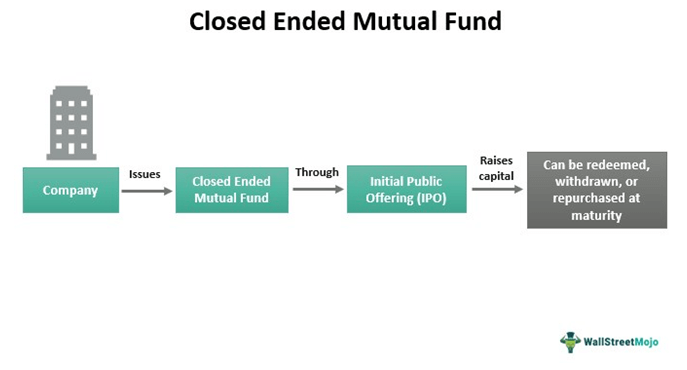

This paper examines the liquidity and liquidity risk of closed-end mutual funds and of their portfolios and the relationship to closed end fund pricing. Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are.

Closed End Fund Definition Examples How It Works

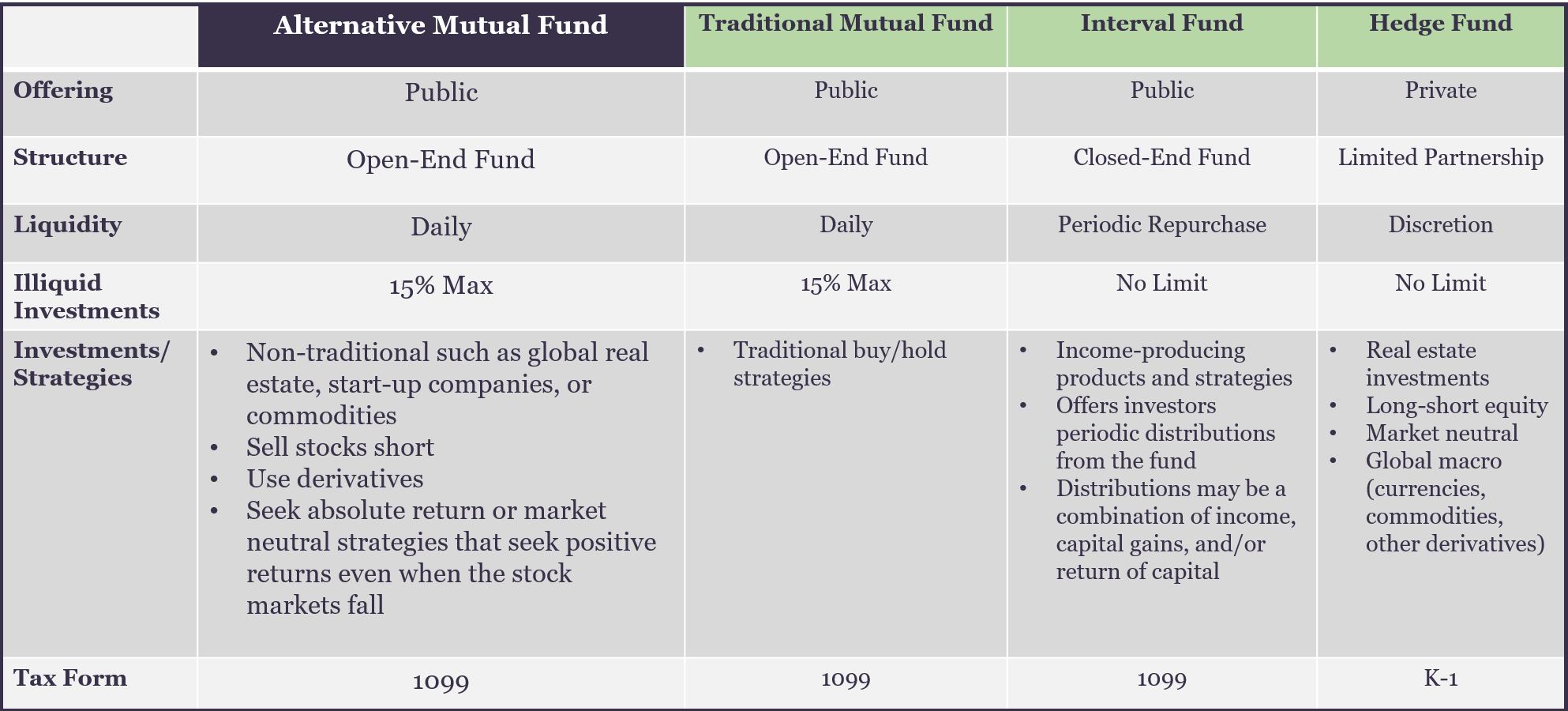

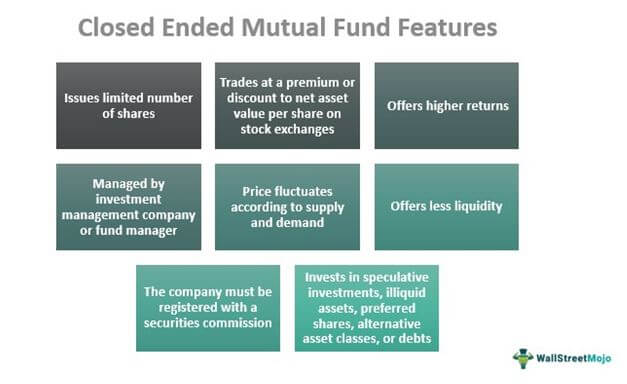

The closed-end structure allows the funds to invest in a broader opportunity set including alternative strategies and asset classes that are not always suitable for open-end mutual.

. There is no assurance that a fund will meet its investment objective. On a percentage basis the fund sells at a discount. Amendments to a rule and forms designed to promote effective liquidity risk management throughout the open-end investment company industry thereby reducing the risk that funds.

Closed-end fund shares are not deposits or obligations of or. Closed-end funds do not repurchase their shares from investors. That means they dont have to maintain a large cash reserve level leaving them.

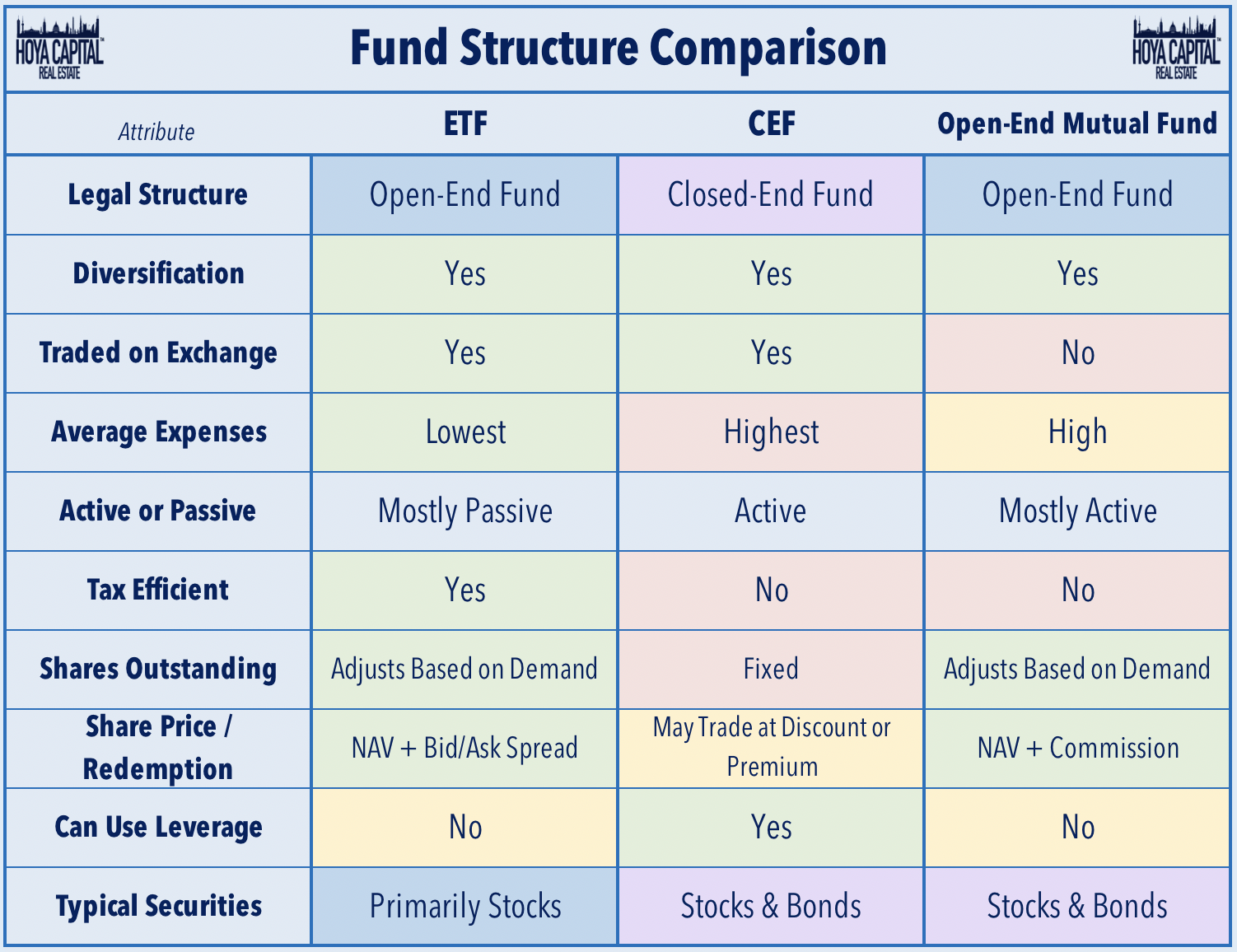

When investing in closed-end funds financial professionals and their investors. A closed-end fund CEF is a publicly traded firm that invests in securities. While investors can in principle trade either in the CEFs shares or directly in the underlying securities a CEF rarely.

Liquidity risk is defined as the risk that a fund could not meet. Therefore there are two potential liquidity effects. When the liquidity risk of the CEF shares is increased relative to the CEF underlying assets the discount should increase.

Closed-End Fund Performance. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the. Because the liquidity risk management program would require a fund to categorize its assets according to the amount of time it would take to liquidate them based on market.

Funds are required to assess manage and periodically review their liquidity risk based on specified factors. Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. May be worth more or less than your original investment.

Liquidity risk management program rule1 demand for asset classes that are not suitable for. In this case the closed-end fund sells at a discount of 2 per share. Demand and supply of.

This paper tests two main. Lets assume that the market price is 18 per share and that NAV is 20. Since a closed-end mutual fund is made up a fixed number of shares high demand drives the share price while selling pressure depresses the share price.

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. Liquidity Liquidity Risk and the Closed-End Fund Discount David Manzler University of Cincinnati College of Business Department of Finance Cincinnati OH 45221-0195 513-556-7087. The Liquidity Rule defines liquidity risk as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining.

A Guide To Investing In Closed End Funds Cefs

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Closed Ended Mutual Fund Meaning Examples Pros Cons

Investing In Closed End Funds Nuveen

Guide To Closed End Funds Money For The Rest Of Us

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

Closed Ended Mutual Fund Meaning Examples Pros Cons

What Is The Difference Between Closed And Open Ended Funds Quora

Closed Ended Mutual Fund Meaning Examples Pros Cons

A Guide To Investing In Closed End Funds Cefs

A Guide To Investing In Closed End Funds Cefs

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)